Judgment: Company Employees to Receive Payment

On 10/30/16, a ruling was given in favor of Khodorov's law firm's clients.

These are two employees who sued the company they worked for for not paying them payments due to them by law.

After leaving the company, Plaintiff 1 discovered to his great surprise that the company owed the plaintiff about NIS 18,000 because no payments were transferred to Clal Insurance, Plaintiff 1's provident fund. The provident fund. However, these funds were never transferred to the provident fund!

After Plaintiff 2 left the company, she immediately began working at a new workplace in October 2015. At the end of that work month, when she received the pay slip from that new workplace, she discovered to her surprise that her new workplace did not allocate funds to her provident fund, as transparent The camel was considered inactive. It was then discovered that the funds deducted from her pay slip while working for the employer for the purpose of depositing in the provident fund were not transferred to the provident fund, without her knowledge - and similar to the situation of Plaintiff 1.

These provisions were claimed from the employing company, and to these sums was also added a claim for compensation for the loss of the estimated interest rates on the principal return, since the money never went into the provident fund.

In addition, Plaintiff 2 was present to know that the new employer is obligated to pay her provident fund contributions only after six months, as if she were a new employee without an active provident fund.

In addition, the two plaintiffs claimed compensation for the mental anguish caused to them.

The lawsuit requested a "screen lift" against the company - an action whose purpose is to ignore the legal separation between the company and the company's owners, in order to reach the assets of the company's owners and its own pocket. This is done in a situation where the company is in a state of "insolvency" - a situation in which the company can not repay its debts.

The defendant company had one owner, who violated the duty of good faith towards the plaintiffs when he caused the company not to knowingly and intentionally transfer payment for their provident fund, a payment which was deducted from the plaintiffs' salary. The owner of the company presented to the plaintiffs a fait accompli that the funds were lawfully transferred, whereas it was in his best interest to disclose his actions to the plaintiffs only when they ceased to work for him.

These blatant violations constitute an abuse of the company's incorporation screen, a cause for raising the screen of incorporation and the personal liability of the company owner in the full obligations of the employer company he owns.

For the purpose of the prosecution, the words of the National Court, which were said in the same case:

"These are very serious things. Not only is the employer violating his employment contract with the employee ... but he is increasing doings by continuing to deduct from employees 'salaries for insurers and not transferring the funds to their certificate. In doing so the employer is not only violating his employees' rights Hand over the employee's money and commits an offense under the Penal Code and an offense under section 26 of the Wage Protection Law (Discussion MA / 115-3 Bnei Akiva Yeshiva Ohel Moshe - Zaguri, FDA 131 171, 181-180 g). In doing so, the employer treats his employees with clear bad faith and in blatant violation of the duty of trust imposed on him in his relationship with them. This is a clear case of a fraudulent act by a company towards its creditors - its employees that justifies raising the veil of incorporation towards the shareholders, even if there are no other grounds for raising the curtain. "(AA (Artzi) 1137/02 Julius Adiv v. M., at p. 13 (published in Nevo, 2003)).

Therefore, the Honorable Court was asked to lift the veil of association between the owner of the company and the company itself, and to charge him personally, jointly and severally, for its actions and deeds which in fact resulted from his will and actions.

The judgment expressed a compromise between the parties which expresses a recognition that such a claim cannot be ignored and defended when an injustice is done to the employees when the employer lawfully deducts payments from their salary but pockets these payments.

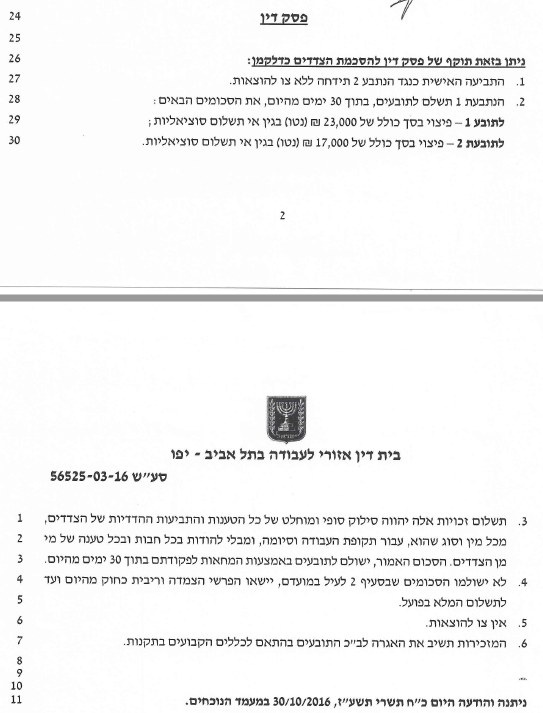

The following is the ruling of the Regional Court in Tel Aviv: